The Journal of Derivatives, 2-4 Summer 1995, pp. 78-95

This paper presents a method for replicating or hedging a target stock option with a portfolio of other options. It shows how to con- struct a replicating portfolio of standard options with varying strikes and maturities and fixed portfolio weights. Once constructed, this portfolio will replicate the value of the target option for a wide range of stock prices and times before expiration, without requiring further weight adjustments. We call this method static replication. It makes no assumptions beyond those of standard options theory.

You can use the technique to construct static hedges for exotic options, thereby minimizing dynamic hedging risk and costs. You can use it to structure exotic payoffs from standard options. Finally, you can use it as an aid in valuing exotic options, since it lets you approx- imately decompose the exotic option into a portfolio of standard options whose market prices and bid-ask spreads may be better known.

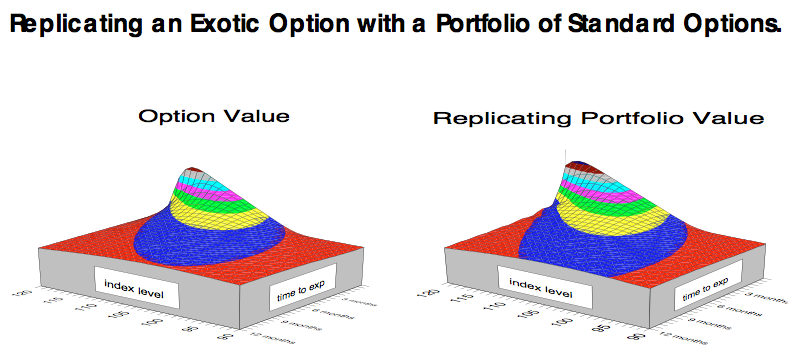

The figure above, taken from an example in this paper, illustrates how the technique works. The graph on the left shows the value of a one-year up-and-out call, struck at 100 with out-barrier at 120, for all times to expiration and for market levels between 90 and 120. The graph on the right shows the value of a replicating portfolio con- structed from seven standard options, struck either at 100 or 120, and expiring every two months over the one-year period. You can see that the replicating portfolio value approximately matches the target option value over a large range of times and stock prices, and has the same general behavior. The more standard options you include in the replicating portfolio, the better the match.