Since the 1987 stock market crash, the S&P 500 index options market has displayed a persistent implied volatil- ity skew.

How should the skew vary as markets move? There are a variety of apocryphal rules and theoretical models, each leading to different predictions.

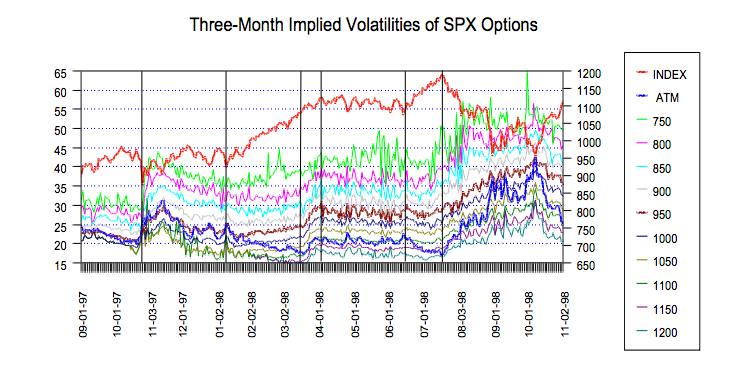

In this report I examine more than a year’s worth of S&P 500 implied volatilities, qualitatively isolating several dis- tinct periods in which different patterns of change seem to hold. For each period, I try to determine which rule or model the volatility market seems to be following, the pos- sible reason why, and whether the change in volatility is appropriate.